19.

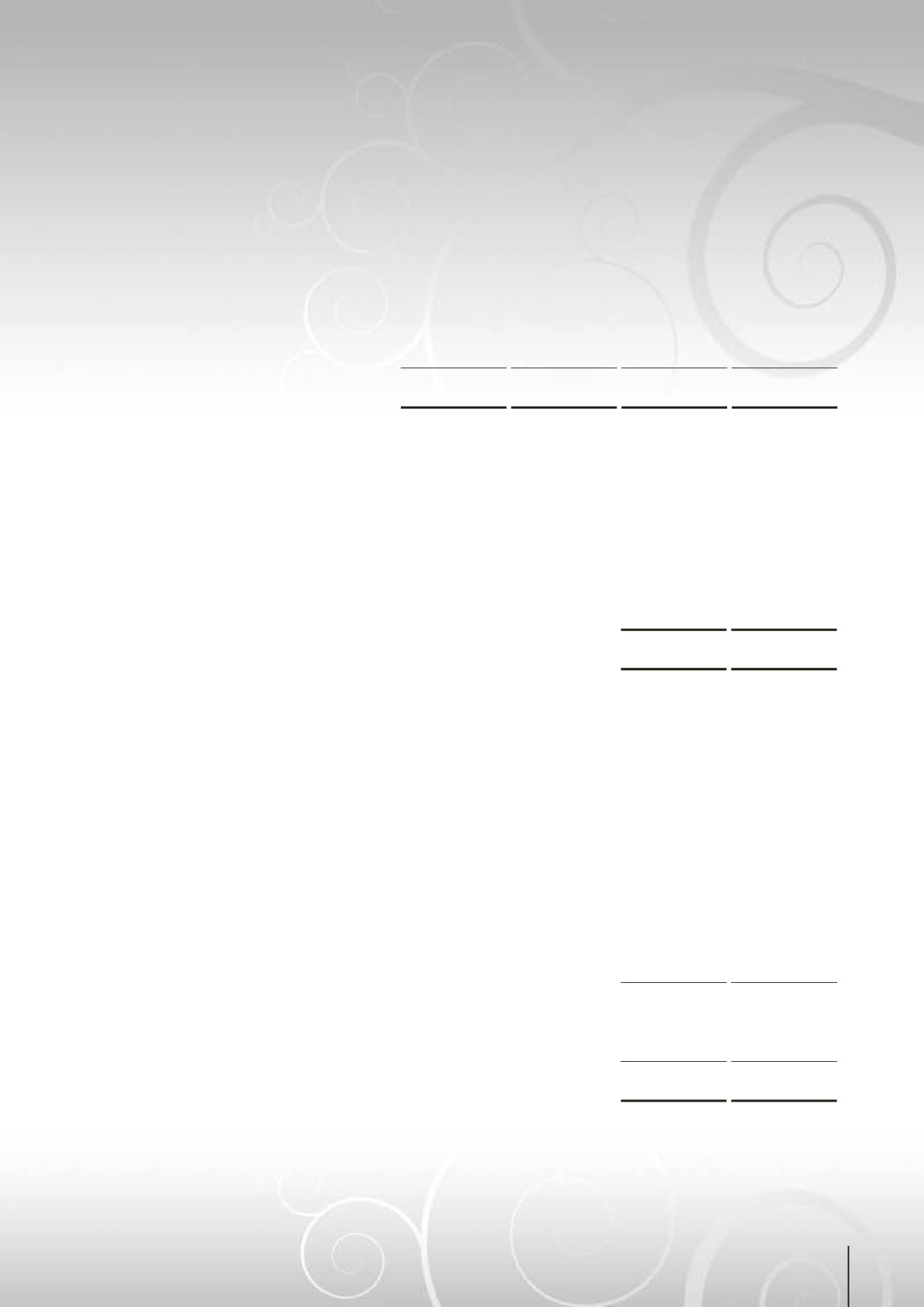

OTHER PAYABLES, ACCRUALS AND PROVISION

GROUP

COMPANY

2014

2013

2014

2013

RM

RM

RM

RM

Other payables

693,441

491,615

14,356

25,340

Deposits received

4,756,282

1,858,973

-

-

Accruals

6,031,309

4,996,310

921,591

856,636

Provision for warranty

127,000

-

-

-

11,608,032

7,346,898

935,947

881,976

20.

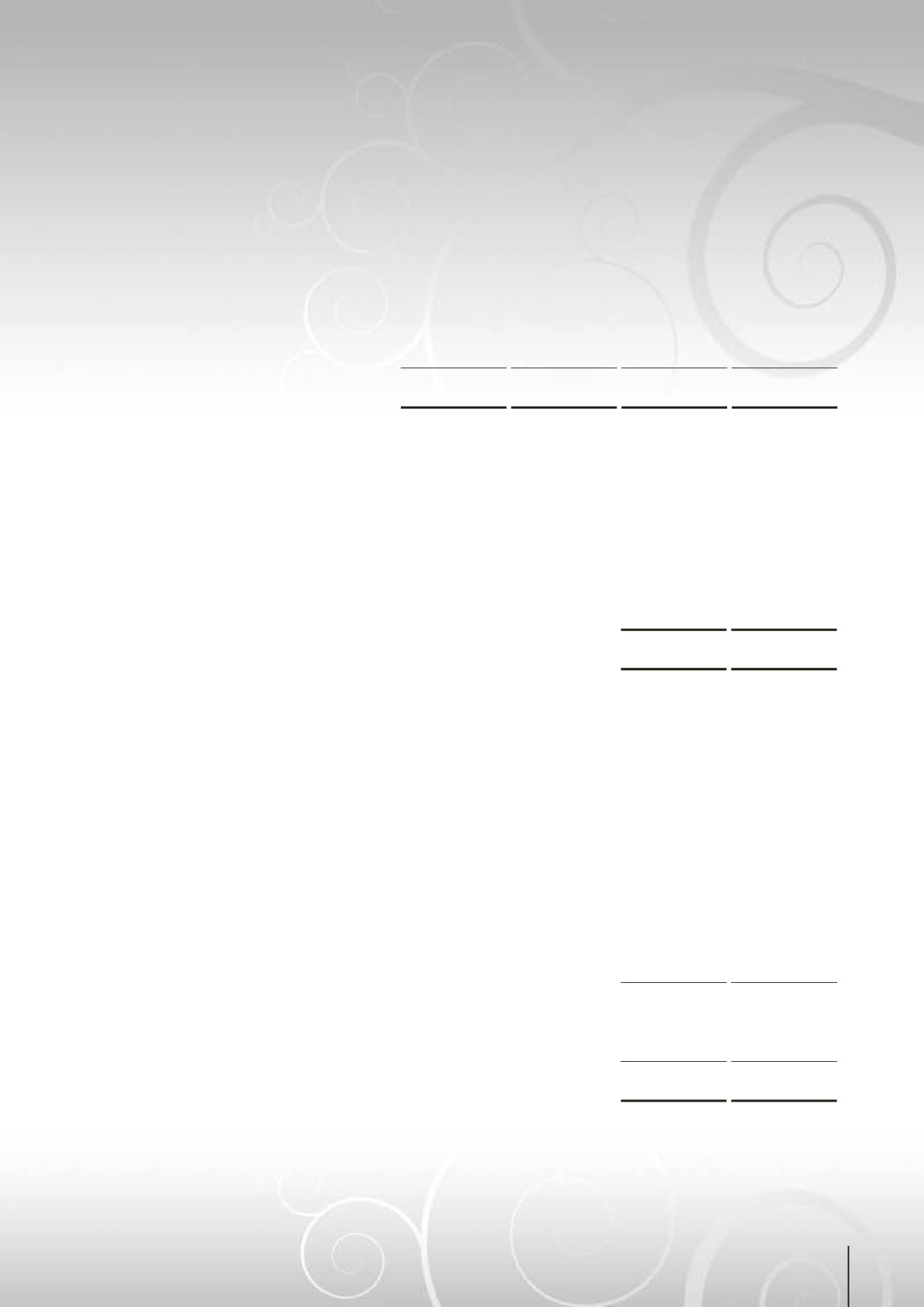

DERIVATIVE FINANCIAL LIABILITIES

GROUP

2014

2013

RM

RM

Derivatives at fair value through profit or loss

- Foreign currency forward contracts

Notional value of contracts

23,496,854

7,502,649

Liabilities

1,305,875

164,462

The Group enters into forward exchange contracts to manage its exposure to sales and purchases

transactions that are denominated in foreign currencies. Forward exchange contracts are recognised as

derivatives, categorised as fair value through profit or loss and are measured at their fair values with gains

or losses recognised in the profit or loss. The forward exchange contracts are not designated as cash flow

or fair value hedges and are entered into for periods consistent with currency transaction exposure. Such

derivatives do not qualify for hedge accounting.

21.

SHORT TERM BANK BORROWINGS

GROUP

2014

2013

RM

RM

Secured:

Bankers’ acceptances

-

3,100,000

Revolving credit

-

3,000,000

-

6,100,000

Unsecured:

Receivables’ factoring

-

280,984

-

6,380,984

The secured portion of the short term bank borrowings are secured by way of a legal charge over the

leasehold land and building of a subsidiary. All borrowings are guaranteed by the Company and certain

subsidiaries.

The effective interest rates charged on the short term bank borrowings range from 4.75% to 6.05% per

annum.

NOTES TO THE FINANCIAL STATEMENTS

31 DECEMBER 2014 (CONT’D)

•

Pentamaster Corporation Berhad

(572307-U)

Annual Report 2014

71