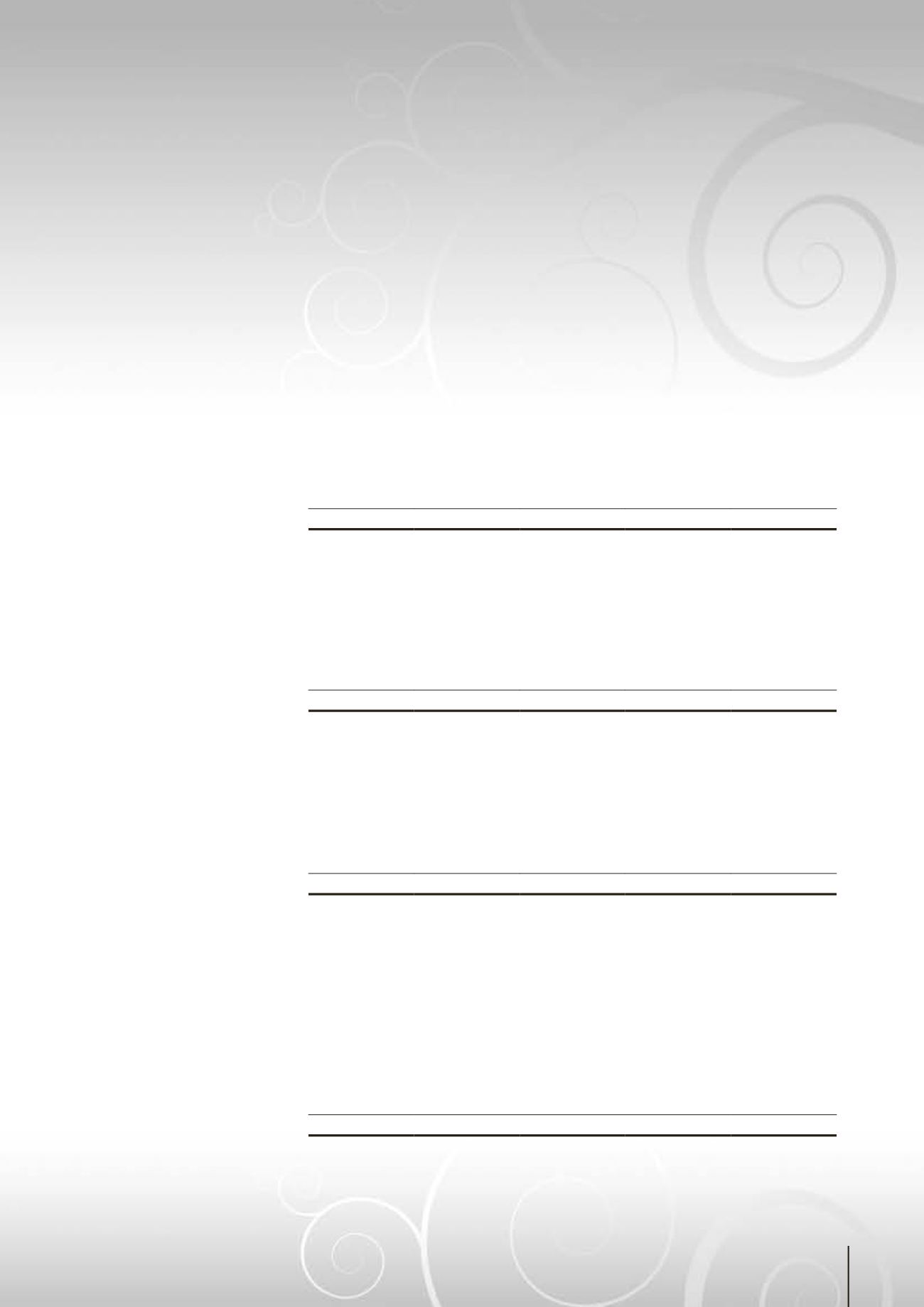

29.

CATEGORIES OF FINANCIAL INSTRUMENTS

The table below provides an analysis of financial instruments categorised as loans and receivables (“L&R”),

available-for-sale financial assets (“AFS”), financial liabilities measured at amortised cost (“FL”) and fair

value through profit or loss (“FVTPL”).

Carrying

amount

L&R

AFS

FL

FVTPL

RM

RM

RM

RM

RM

GROUP

2014

Financial assets

Other investments

1,359,900

- 1,359,900

-

-

Trade receivables

20,123,542 20,123,542

-

-

-

Other receivables

877,630 877,630

-

-

-

Cash and cash

equivalents

8,382,388 8,382,388

-

-

-

30,743,460 29,383,560 1,359,900

-

-

Financial liabilities

Trade payables

9,600,566

-

- 9,600,566

-

Other payables

6,724,750

-

- 6,724,750

-

Derivative financial

liabilities

1,305,875

-

-

- 1,305,875

Finance lease

liabilities

188,408

-

-

188,408

-

17,819,599

-

- 16,513,724 1,305,875

2013

Financial assets

Other investments

1,359,900

-

1,359,900

-

-

Trade receivables

18,683,638 18,683,638

-

-

-

Other receivables

680,044

680,044

-

-

-

Cash and cash

equivalents

4,898,974 4,898,974

-

-

-

25,622,556 24,262,656 1,359,900

-

-

Financial liabilities

Trade payables

10,464,585

-

- 10,464,585

-

Other payables

5,487,925

-

-

5,487,925

-

Derivative financial

liabilities

164,462

-

-

- 164,462

Short term bank

borrowings

6,380,984

-

-

6,380,984

-

Finance lease

liabilities

314,290

-

-

314,290

-

22,812,246

-

- 22,647,784 164,462

NOTES TO THE FINANCIAL STATEMENTS

31 DECEMBER 2014 (CONT’D)

•

Pentamaster Corporation Berhad

(572307-U)

Annual Report 2014

81