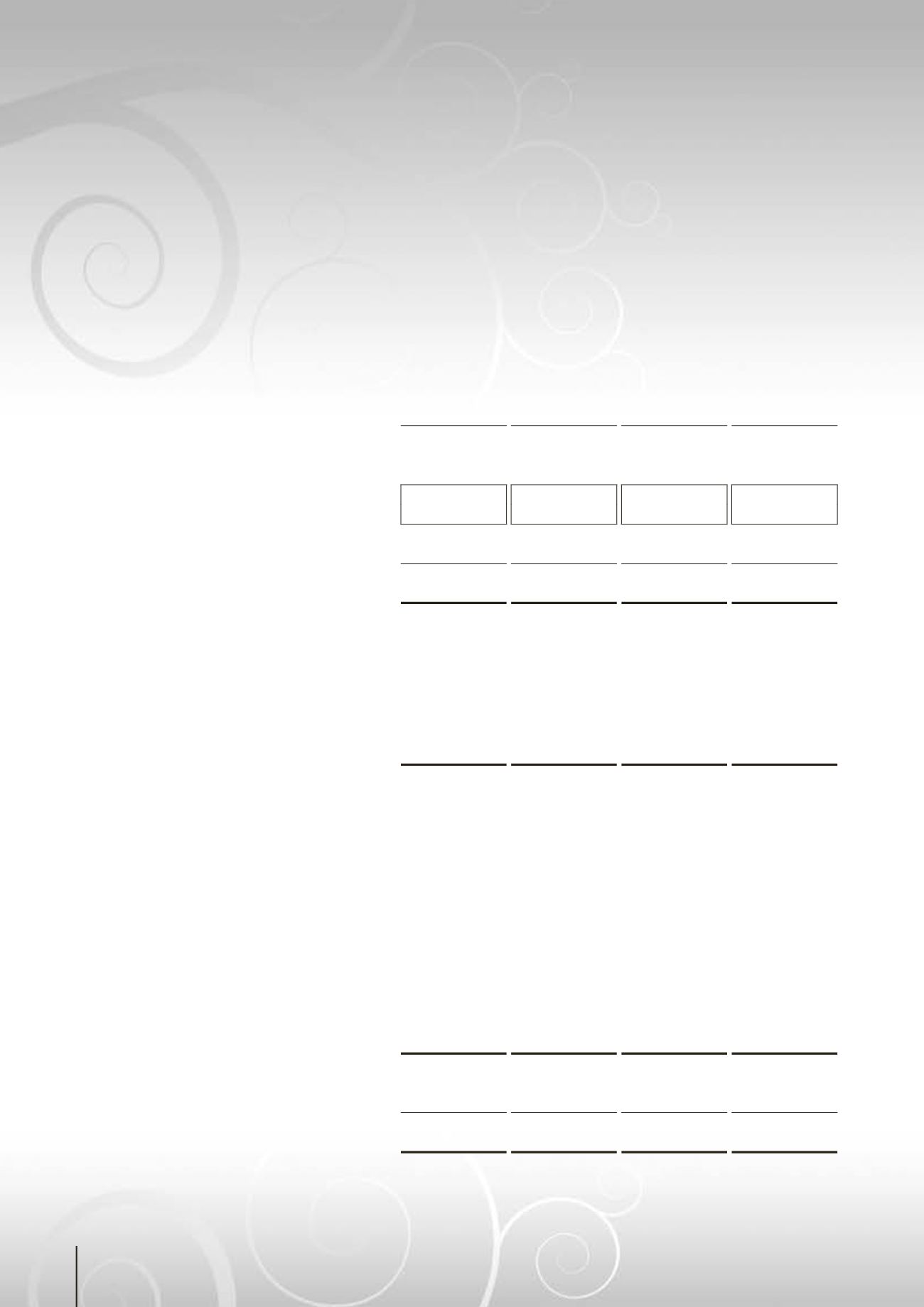

24.

TAXATION

GROUP

COMPANY

2014

2013

2014

2013

RM

RM

RM

RM

Malaysian income tax:

Based on results for the financial year

- Current tax

(645,026)

(408,966)

-

(1,504)

- Deferred tax

Relating to origination and reversal of

temporary differences

(760,000)

(720,000)

-

-

(1,405,026)

(1,128,966)

-

(1,504)

Over provision in prior year

- Current tax

16,411

62,558

1,504

2664

- Deferred tax

80,000

-

-

-

96,411

62,558

1,504

2,664

(1,308,615)

(1,066,408)

1,504

1,160

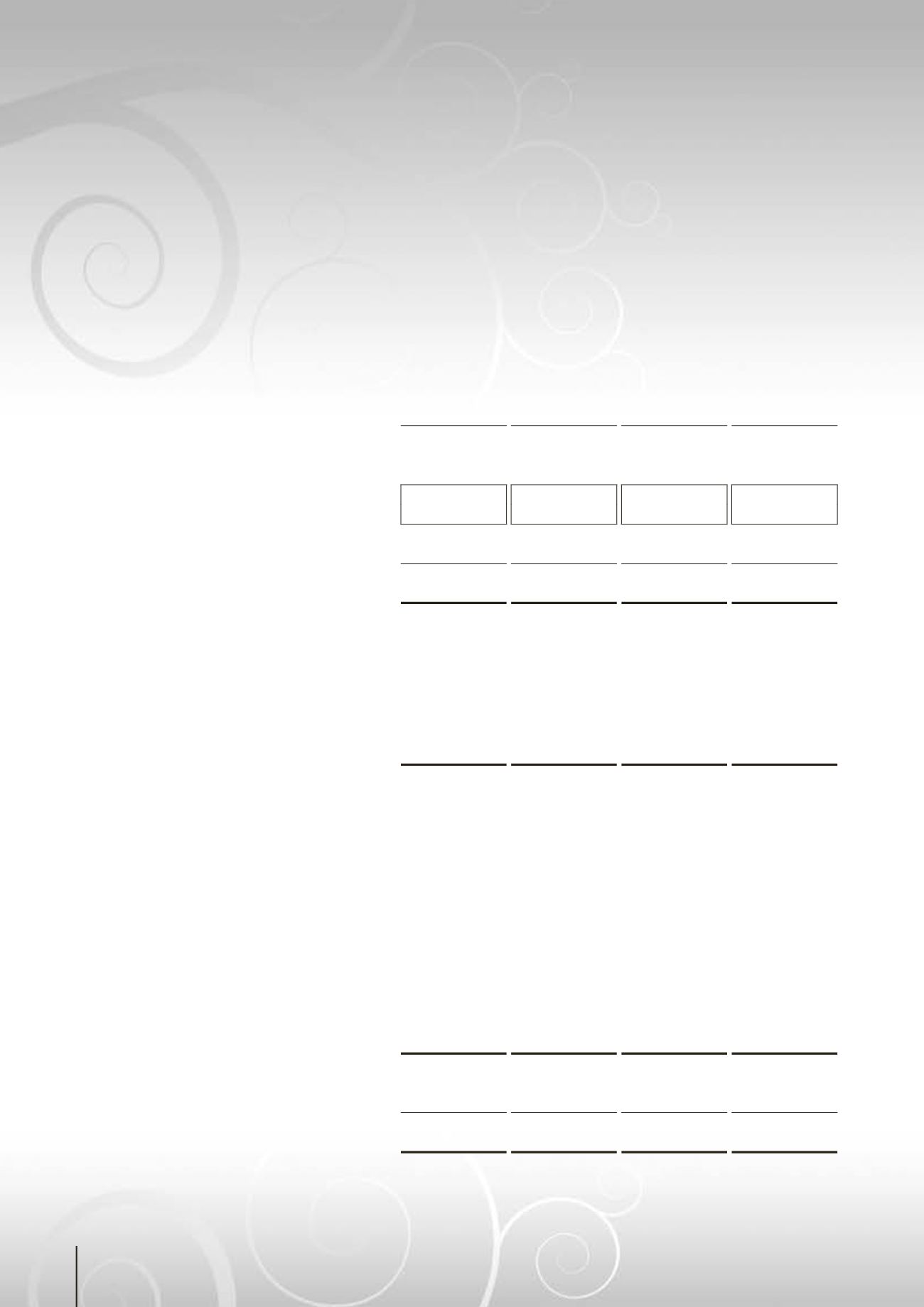

The reconciliation of tax expense of the Group and of the Company is as follows:

GROUP

COMPANY

2014

2013

2014

2013

RM

RM

RM

RM

Profit/(Loss) before taxation

7,351,467

3,918,325

(5,630,743)

(899,468)

Income tax at Malaysian statutory tax

rate of 25%

(1,837,867)

(979,581)

1,407,686

224,867

Income not subject to tax

214,382

562,203

-

13,728

Exempt pioneer income

1,021,609

516,745

-

-

Expenses not deductible for tax

purposes

(477,619)

(366,968)

(1,168,151)

(51,192)

Deferred tax movement not recognised

(1,355,358)

(1,732,224)

(239,535)

(188,907)

Tax effects of expenses available for

double deduction

46,981

46,020

-

-

Recognition of previously unrecognised

tax losses

(i)

624,000

-

-

-

Utilisation of unabsorbed tax losses

and capital allowances

242,846

824,839

-

-

Changes in tax rate

(ii)

116,000

-

-

-

(1,405,026)

(1,128,966)

-

(1,504)

Over provision in prior year

96,411

62,558

1,504

2,664

(1,308,615)

(1,066,408)

1,504

1,160

(i)

A subsidiary of the Group had revised its internal profit forecast and projections and estimated that

it is probable that future taxable profit will be available to offset against the unabsorbed tax losses.

Arising from this, unabsorbed tax losses amounting to RM2,600,000 as at 31 December 2014 is

recognised as deferred tax assets as at that date.

NOTES TO THE FINANCIAL STATEMENTS

31 DECEMBER 2014 (CONT’D)

Pentamaster Corporation Berhad

(572307-U)

•

Annual Report 2014

74