Financials

Quarterly Report For The Financial Period Ended 30 September 2025

![]() Note: Files are in Adobe (PDF) format.

Note: Files are in Adobe (PDF) format.

Please download the free Adobe Acrobat Reader to view these documents.

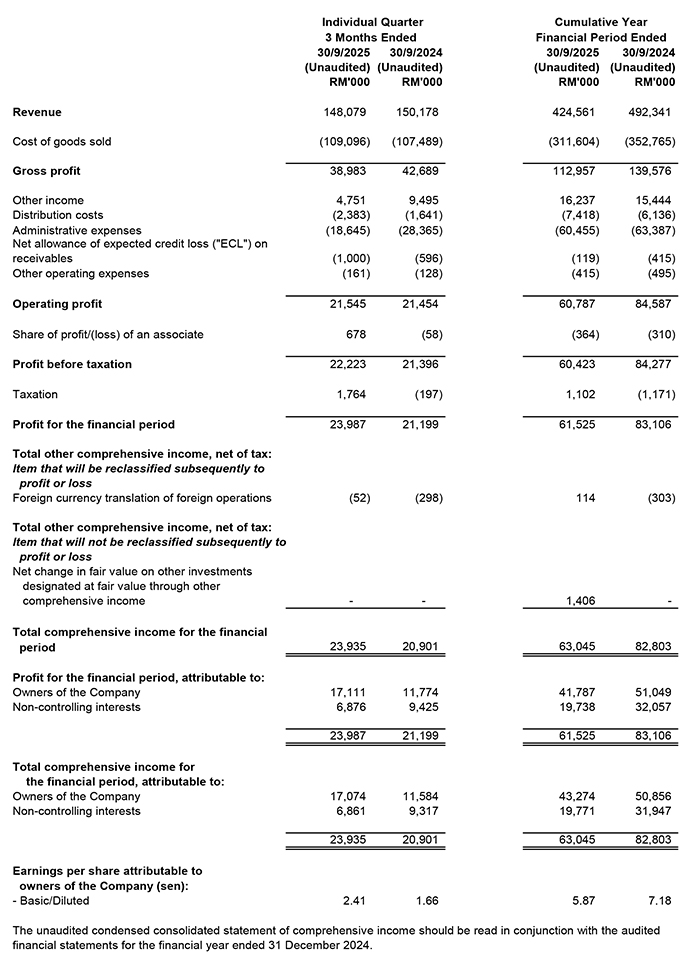

Unaudited Condensed Consolidated Statement Of Profit Or Loss And Other comprehensive Income For The Year Ended 30 September 2025

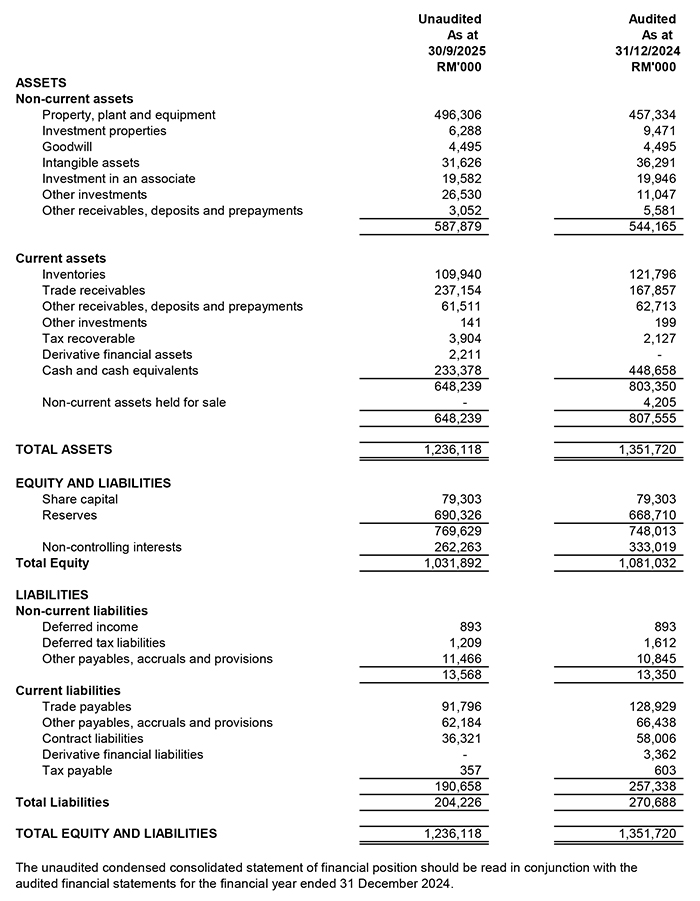

Unaudited Condensed Consolidated Statement Of Financial Position as At 30 September 2025

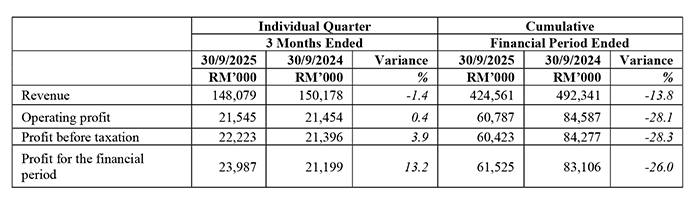

Review of Performance

The Group recorded a quarterly revenue of RM148.1 million for the three months ended 30 September 2025 ("3Q2025") as compared to RM150.2 million registered in the corresponding quarter ended 30 September 2024 ("3Q2024"), representing a slight decrease of approximately 1.4%. For nine months period ended 30 September 2025 ("9M2025"), the Group's revenue stood at RM424.6 million as compared to RM492.3 million in the corresponding period ended 30 September 2024 ("9M2024"), representing a decrease of approximately 13.8%.

The Group's revenue was primarily derived from the ATE and FAS segments, which contributed approximately 26.1% and 67.3% respectively to the Group's total revenue in 3Q2025 and 51.2% and 46.3% respectively for the 9M2025 period.

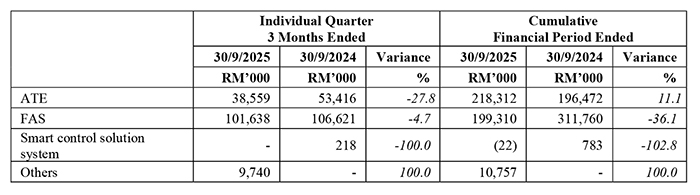

The table below outlines the revenue of the respective operating segments, including elements of inter-segment transactions.

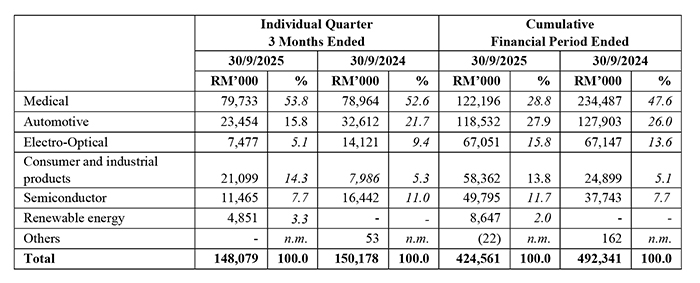

The following table sets out revenue breakdown by customers' segment for the Group:

The Group closed its 3Q2025 with a profit before taxation of RM22.2 million (3Q2024: RM21.4 million), representing a marginal increase of approximately 3.9% from last year's corresponding period. The Group closed its 9M2025 with a profit before taxation of RM60.4 million, a drop from a profit before taxation of RM84.3 million achieved in 9M2024. Accordingly, the Group's EBITDA (earnings before interest, tax, depreciation and amortisation) for the 3Q2025 stood at RM29.7 million (3Q2024: RM26.8 million), representing an increase of 11.0%, while the Group's EBITDA for the 9M2025 stood at RM81.8 million (9M2024: RM100.0 million), representing a decrease of 18.2% from corresponding period last year respectively. Basic earnings per share increased from 1.66 sen in 3Q2024 to 2.41 sen in 3Q2025 but decreased from 7.18 sen in 9M2024 to 5.87 sen in 9M2025.

The performance of the respective operating segments which includes inter-segment transactions for the current quarter as compared to the previous corresponding quarter is analysed as follows:

-

Automated test equipment

Revenue from this segment declined by RM14.9 million from RM53.4 million in the previous corresponding quarter to RM38.6 million in 3Q2025, primarily due to lower sales contributions from the automotive and electro-optical segments during the quarter. Within the ATE segment, the automotive sector remained the largest contributor, accounting for approximately 60.5% of the segment's revenue in 3Q2025. Revenue from this sector, however, declined by 17.9% compared to 3Q2024 largely due to timing differences in project deliveries within the automotive industry. On a nine-month basis, the automotive segment contributed 53.2% to the ATE segment in 9M2025 as compared to 63.9% in 9M2024, with revenue from this sector declining marginally by 3.4% as compared to the corresponding period last year. Overall, the Group's ATE segment witnessed resilient demand from the automotive segment supported by its broad and comprehensive product portfolio in the wide-bandgap semiconductor business segment, covering end-to-end test and assembly solutions for customers across Singapore, China, the United States, Malaysia, Japan and Europe.

Meanwhile, revenue from the electro-optical segment decreased from RM6.4 million in 3Q2024 to RM3.9 million in 3Q2025, representing a drop of 38.9% within the ATE segment. The lower sales performance was mainly attributable to the nature of project deliveries during the quarter which primarily involved module upgrades and its related ancillary parts. However, on a nine-month basis, the electro-optical segment contributed 24.2% to the ATE segment in 9M2025, up slightly from 23.5% achieved in 9M2024, with revenue from this sector recording an overall increase of 19.3% as compared to the corresponding period last year.

After registering revenue growth in the first half of the year, the semiconductor sector continued to demonstrate improved momentum by contributing 28.9% to the Group's ATE revenue in 3Q2025, up from 20.6% in 3Q2024, representing an increase of 21.6%. For 9M2025, the semiconductor sector contributed 22.2% to the ATE segment as compared to 11.8% in 9M2024. The growth was mainly driven by the gradual recovery in customer demand following the industry's inventory adjustment cycle, which led to higher demand for the Group's semiconductor test handling equipment. The positive momentum also reflects the broader market's readiness for production ramp-up and investment in new test platforms in anticipation of the next semiconductor growth cycle.

Overall, the ATE segment recorded a loss before taxation of RM5.6 million in 3Q2025 compared to a profit before taxation of RM4.3 million in 3Q2024. The loss was mainly attributable to the lower revenue recorded during the quarter, resulting in diseconomies of scale. This performance also reflected timing differences in project deliveries whereby revenue contributions from certain projects are expected to be progressively recognised in subsequent quarters.

-

Factory automation solutions

In 3Q2025, revenue from the FAS segment declined slightly by 4.7% to RM101.6 million as compared to RM106.6 million achieved in 3Q2024. The marginal decrease was mainly due to lower revenue contributions from the medical, electro-optical and semiconductor segments. However, this was partially offset by higher contributions from the consumer and industrial products segment as well as the renewable energy segment. Within the FAS segment, the medical segment's share of revenue contracted to 70.3% in 3Q2025 as compared to 74.8% in 3Q2024, representing a reduction of 11.4%. On a nine-month basis, the medical segment contributed 56.7% to the FAS segment in 9M2025 as compared to 76.9% in 9M2024. The lower proportion of revenue from the medical sector is viewed positively as it reflects the Group's ongoing efforts to diversify its FAS revenue base and reduce dependency on a single industry, thereby lowering concentration risk.

The consumer and industrial products segment, on the other hand, accounted for approximately 21.0% of the FAS segment's revenue in 3Q2025, marking a notable increase from 7.1% in 3Q2024, which translated into substantial revenue growth of 177.4%. On a nine-month basis, this segment contributed 29.3% to the FAS segment in 9M2025 as compared to a single-digit level of 7.7% in 9M2024. The renewable energy segment, which began contributing to the FAS segment in 2Q2025, continued to record a positive contribution of 4.9% in 3Q2025. Other industry segments such as the electro-optical and semiconductor segments made up the remaining portion of the FAS segment's revenue.

In tandem with the slight decline in revenue, the FAS segment recorded a lower profit before taxation of RM27.7 million in 3Q2025, representing a 7.0% decrease from RM29.8 million in 3Q2024. Overall, the FAS segment's revenue remained healthy, underpinned by a balanced mix of orders from the medical, consumer and renewable energy sectors. The medical sector's performance, however, has normalised to a more sustainable level following a high base in the previous year, while other sectors particularly consumer and renewable energy are progressively strengthening their contributions to the FAS segment's overall performance.

-

Smart control solution system

The products and solutions in this segment entail project management, smart building solutions and trading of materials.

In 3Q2025, no revenue was recorded under the smart control solution system segment, as compared to a revenue of RM0.2 million recorded in 3Q2024. This segment recorded a marginal loss before taxation of RM54,000 in 3Q2025 mainly attributable to its running fixed costs. In comparison, a higher loss before taxation of RM0.9 million was recorded in 3Q2024.

Prospect

The Group's order book is gradually strengthening with encouraging momentum, supported by a steady inflow of new purchase orders from both existing and new customers across its key business segments. These orders are predominantly projectbased with delivery timelines extending into 2026 and accordingly, the related revenue contribution will be recognised progressively from next financial year onwards. For 2025, the Group anticipates a modest revenue performance as compared to 2024, reflecting a transition period as the Group lays its foundation for the next emerging powerful growth catalyst. Barring any unforeseen circumstances, the Group expects its growth trajectory to gain renewed momentum in 2026, driven by the execution of these new projects and sustained customer demand across its strategic markets in the logic and power semiconductor business segments.

In preparation for the next growth phase, the Group will continue to invest strategically in research and development ("R&D"), particularly in advanced packaging and copackaged optics ("CPO") test and assembly solutions to reinforce its innovation capabilities and strengthen its market positioning. Leveraging its strong engineering foundation, the Group is intensifying its R&D efforts to roll out a comprehensive portfolio of test and assembly equipment encompassing wafer inspection and acceptance system, high-power burn in system, silicon photonics and CPO test systems, among others. These solutions are designed to address the increasing complexity and performance requirements of artificial intelligence ("AI") accelerators in highperformance computing systems, hyperscale infrastructure, chiplet architectures and wide-bandgap semiconductor devices. Through continuous innovation and close collaboration with global customers, the Group aims to capture emerging opportunities across the AI and semiconductor value chain while further enhancing its technological competitiveness, operational agility and margin resilience.

Looking ahead, the Group remains cautiously optimistic as global semiconductor and technology investments continue to gain momentum, driven by the proliferation of AI applications, data-centric ecosystems and advanced computing architectures. Backed by a diversified customer base across different geographical regions, strong engineering capabilities and extensive manufacturing capacity, the Group is well positioned to capitalise on these structural growth trends. Moving forward, the Group will continue to execute with discipline, focusing on operational excellence and long-term value creation, while remaining vigilant against macroeconomic and geopolitical developments that may influence the pace of industry recovery.